Fica Limit 2025 Dollar Amount Worksheet. Social security tax rate for 2025: In 2025, only the first $168,600 of your earnings are subject to the social security tax.

For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the.

Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount.

The amount of any federal income tax withholding must be based on filing status, income (including income from other jobs), deductions, and credits.

Irs Fica Limit 2025 Carin Cosetta, The wage base or earnings limit for the 6.2% social security tax rises every year. In 2025, the social security tax limit rises to $168,600.

2025 Fica Tax Limit Lorri Malvina, The amount of any federal income tax withholding must be based on filing status, income (including income from other jobs), deductions, and credits. Federal insurance contributions act (fica) changes.

FICA Limit 2025 How It Affects You, Social security wage base limit for 2025: Starting with the month you reach full retirement age, you.

What Is Fica Limit For 2025 Sammy Coraline, In 2025, the social security tax limit rises to $168,600. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount.

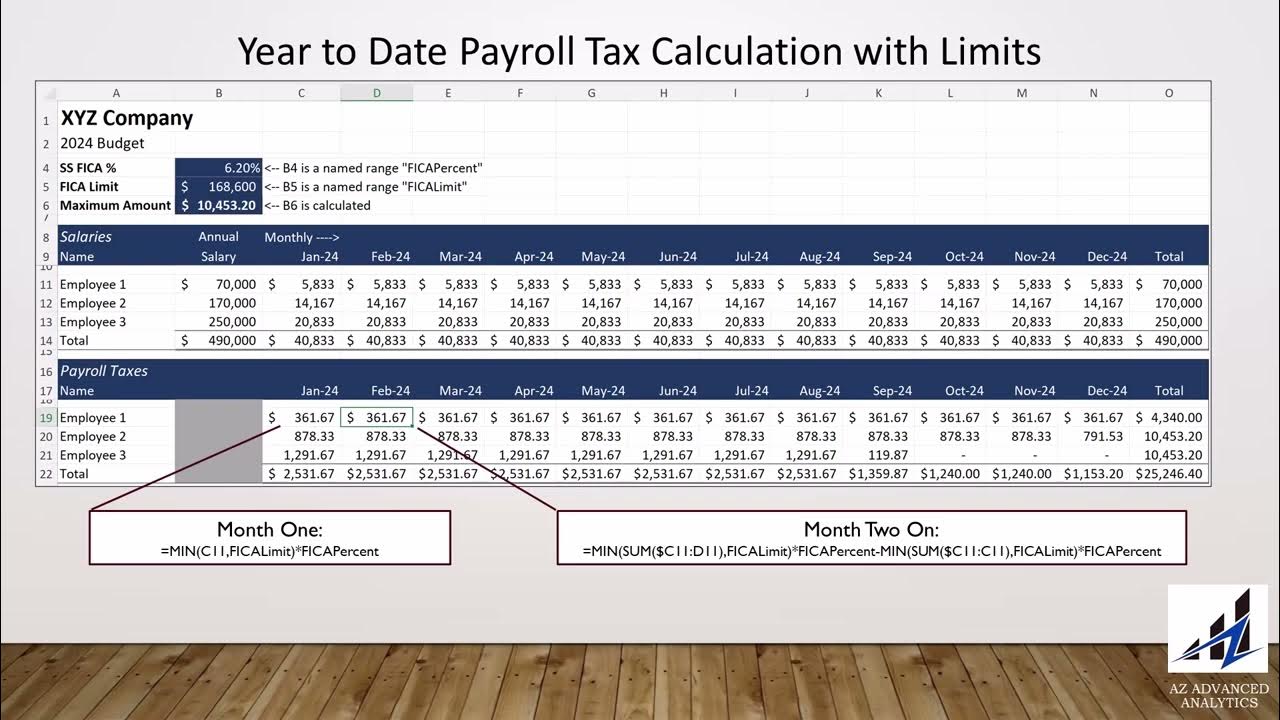

Excel Model for Budgeting Payroll Tax Expense with FICA Limits YouTube, Attention to detail is important when discussing fica rates and limits, as they may change each calendar year. The amount of any federal income tax withholding must be based on filing status, income (including income from other jobs), deductions, and credits.

FICA Limit 2025 How It Affects You, This income ceiling is also the maximum amount of money that’s considered when calculating the size of social security benefits: Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act.

Hsa Deduction Amount For 2025 Married Filing Enid Odelia, Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act. 6.2% for both the employer and the employee.

Fy 2025 Limits Documentation System Image to u, Attention to detail is important when discussing fica rates and limits, as they may change each calendar year. What are the fica rates and limits for 2025?

Max Social Security Tax 2025 Dollar Amount Magda Roselle, Social security wage base limit for 2025: Fica tax rates are statutorily set.

How Much Is Fica 2025 Abbey, This income ceiling is also the maximum amount of money that’s considered when calculating the size of social security benefits: The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the.